Crypto Insights Daily – March 14, 2025 🚀

- Crypto Alpha

- Mar 14, 2025

- 4 min read

Updated: Mar 15, 2025

March 14, 2025

Market Overview

The cryptocurrency market is experiencing an upward trend, with several major cryptocurrencies showing gains.

Bitcoin (BTC): Trading at $84,291, up 4.34% from the previous close.

Ethereum (ETH): Currently at $1,930.72, reflecting a 4.57% increase.

XRP (XRP): Priced at $2.34, marking a 4.00% rise.

Solana (SOL): Standing at $133.24, up 8.68%.

Cardano (ADA): Trading at $0.73478, with a 4.33% increase.

Today's biggest mover is Chainlink (LINK): trading at $14.53 up $1.53 or 11.6%

Market Metrics

Total Cryptocurrency Market Capitalization: Approximately $2.71 trillion, reflecting a 100 billion increase over yesterday.

Bitcoin Dominance (BTC.D): Maintains at 61.9%, indicating Bitcoin's continued market influence.

Altcoin Market Capitalization: Stands at $1.03 trillion, showing resilience amid market fluctuations.

Note: Cryptocurrency market metrics are highly dynamic and can change rapidly. For the most current information, refer to reliable financial news sources or real-time market data platforms.

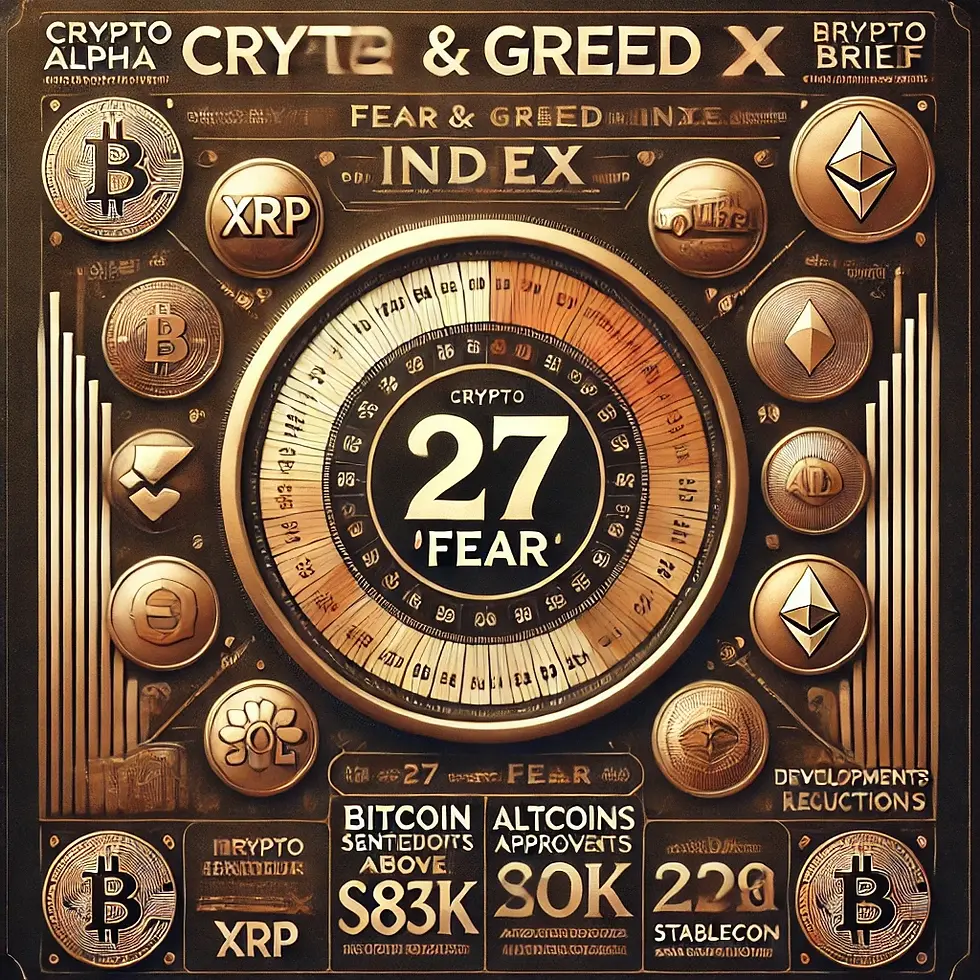

📈 Current Market Sentiment

Crypto Fear & Greed Index: 27 (Fear)

Investor Outlook: This suggests investors are cautious and may be selling, potentially creating buying opportunities for others.

Note: The Crypto Fear & Greed Index is a tool that measures the prevailing sentiment of the cryptocurrency market, ranging from 0 (Extreme Fear) to 100 (Extreme Greed). It helps investors gauge market emotions, which can influence buying and selling decisions.

For a historical view of the Crypto Fear and Greed index check out this site below.

🔥 Daily Highlights

FTX Liquidated $1.5B in 3AC Assets: FTX liquidated $1.53 billion in Three Arrows Capital assets before its collapse in 2022. 3AC claims this was undisclosed, leading to a court allowing them to pursue a larger claim against FTX.

Bitcoin-to-Gold Ratio Breaks 12-Year Support: Bitcoin broke a 12-year support trendline against gold, potentially ending its long-term bull run, as gold hit a record $3,000 per ounce. Bitcoin dropped 11% in 2025, while gold ETFs saw significant inflows.

Congress Repeals IRS Broker Rule, DeFi Regulation in Question: Congress nullified an IRS rule requiring DeFi protocols to report crypto sales, citing privacy concerns. The industry fears regulation may push DeFi offshore. Clear guidelines are still needed.

The U.S. Senate is set to vote on the GENIUS Act, a significant stablecoin bill aiming to provide federal legitimacy to stablecoins and boost their adoption as mainstream payment options. Co-sponsored by Senators Bill Hagerty and Kirsten Gillibrand, the bill proposes a dual regulatory framework for stablecoin issuers, allowing registration with either state or federal authorities. Critics, including Senator Elizabeth Warren, warn that it could lead to a Big Tech takeover of the dollar, highlighting potential risks such as insufficient federal consumer safeguards and financial instability.

Deep Dive: Understanding Cryptocurrency Wallets

In the evolving landscape of digital finance, cryptocurrency wallets play a pivotal role in securing and managing digital assets. Understanding the different types of wallets and their functionalities is essential for both new and seasoned investors.

Types of Cryptocurrency Wallets

Hardware WalletsPhysical devices that store private keys offline, providing robust security against online threats. Example: Ledger Nano S, Trezor.

Software WalletsApplications or programs installed on computers or mobile devices, offering a balance between convenience and security. Example: Exodus, Electrum.

Web WalletsOnline services accessible through web browsers, allowing quick access but potentially posing security risks if not properly managed. Example: Coinbase Wallet, MetaMask.

Paper WalletsPhysical printouts or handwritten notes of private and public keys, kept offline to prevent hacking but requiring careful handling to avoid loss or damage.

Key Considerations When Choosing a Wallet

Security: Evaluate the wallet's security features, such as encryption and two-factor authentication.

Control: Determine whether you have full control over your private keys.

Convenience: Consider the ease of use and accessibility based on your trading habits.

Compatibility: Ensure the wallet supports the cryptocurrencies you intend to store.

Best Practices for Wallet Security

Regular Backups: Maintain updated backups of your wallet to recover funds in case of device failure.

Strong Passwords: Use complex passwords and change them periodically.

Be Cautious: Avoid sharing your private keys or seed phrases with anyone.

Understanding and implementing proper wallet management strategies is crucial for safeguarding your digital assets in the dynamic world of cryptocurrencies.

Note: The information provided is based on the current market conditions as of March 11, 2025, and is subject to change with market dynamics.

Do you want to know when to buy and when to sell a crypto? Opt-In for Free Crypto Trade Alerts (Beta)

Introducing the Crypto Alpha Ultimate Algorithm BETA—Now in Beta & Free for Early Subscribers!

Get real-time crypto trade alerts directly to your email & phone.

Why Join?

Powered by the Crypto Alpha Algorithm: Identifies optimal buy/sell signals based on real-time market conditions.

Institutional-Grade Data: Leveraging cutting-edge analytics for maximum accuracy.

Beta Launch = Free Access!: Get in early while we fine-tune the algorithm.

This is your chance to get real-time insights from a powerful crypto market algorithm at no cost.

👇 Opt-in now and start receiving trade alerts!

Comments