Crypto Insights Daily – March 21, 2025 🚀

- Crypto Alpha

- Mar 21, 2025

- 6 min read

Updated: Mar 22, 2025

March 21, 2025

Market Overview

The cryptocurrency market is experiencing a sideways trend today, with major assets showing little gains:

Bitcoin (BTC): $83,914

Ethereum (ETH): $1,959

XRP (XRP): $2.37

Solana (SOL): $126.11

Cardano (ADA): $0.7027

Market Metrics

Total Cryptocurrency Market Cap: $2.7 trillion, reflecting a $20 billion decrease over the past 24 hours.

Bitcoin Dominance (BTC.D): 61.63%, indicating BTC's continued market leadership.

Altcoin Market Capitalization: $1.04 trillion, as investors show slowing interest in alternative cryptocurrencies.

Note: Cryptocurrency market metrics are highly dynamic and can change rapidly. For the most current information, refer to reliable financial news sources or real-time market data platforms.

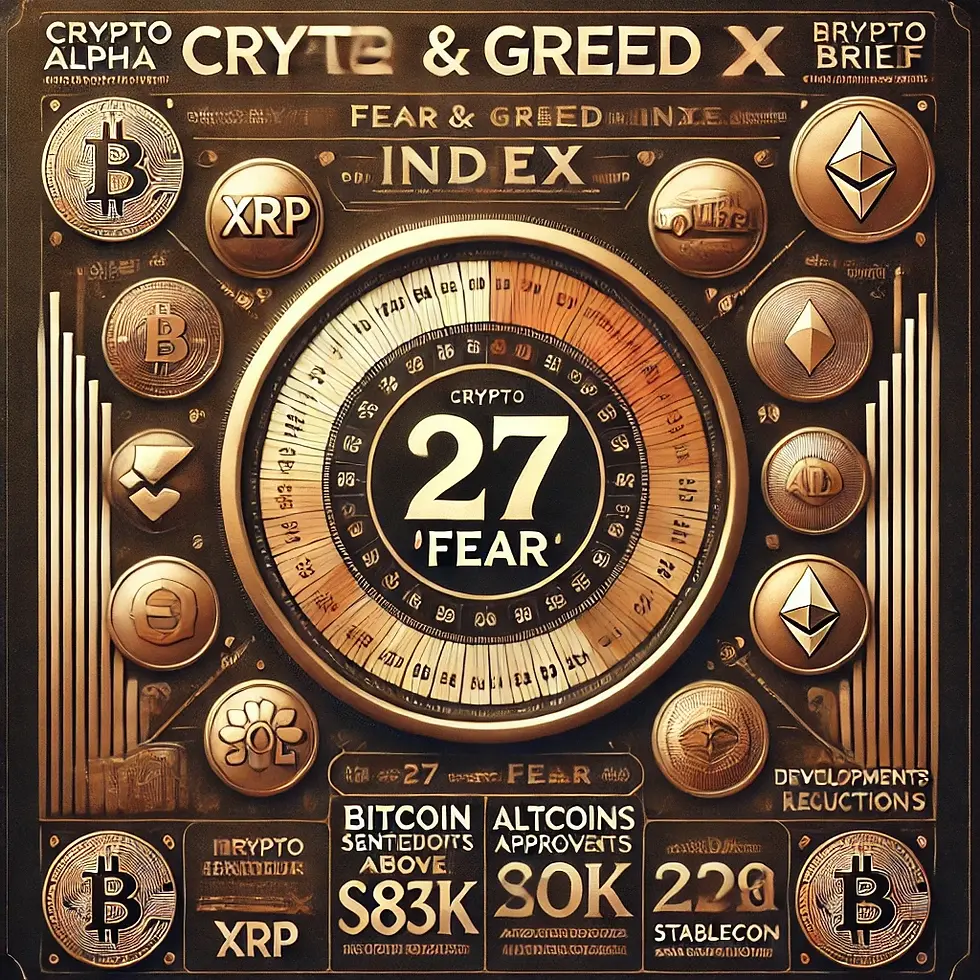

📈 Current Market Sentiment

Crypto Fear & Greed Index: 27 (Fear)

Investor Outlook: Fear is fading as bullish momentum picks up.

The Fear & Greed Index at 27 suggests that investors remain cautious, with market sentiment leaning towards fear due to recent market fluctuations and economic concerns.

Note: The Crypto Fear & Greed Index is a tool that measures the prevailing sentiment of the cryptocurrency market, ranging from 0 (Extreme Fear) to 100 (Extreme Greed). It helps investors gauge market emotions, which can influence buying and selling decisions.

For a historical view of the Crypto Fear and Greed index check out this site below.

🔥 Daily Highlights

Kraken Acquires NinjaTrader for $1.5 Billion

In a strategic move to diversify its offerings, Kraken, a leading cryptocurrency exchange, has announced plans to acquire NinjaTrader, a prominent retail futures trading platform, for $1.5 billion. This acquisition aims to broaden Kraken's asset class offerings and expand its user base. The deal is expected to finalize in the first half of 2025.

President Trump Pledges U.S. Leadership in Cryptocurrency

President Donald Trump has declared his intention to position the United States as the global leader in Bitcoin and cryptocurrency. In a recent address, he announced efforts to eliminate previous regulatory restrictions on crypto and emphasized the need for clear regulations to foster innovation and investment. Initiatives include the creation of a strategic Bitcoin Reserve, likened to a digital Fort Knox, to ensure sustained U.S. dominance in the crypto sector.

North Korea's Cryptocurrency Heists Elevate Its Bitcoin Holdings

North Korea has become the third-largest holder of Bitcoin globally, following the United States and the United Kingdom. This position results from the activities of its cyber-hacking group, Lazarus, which has amassed approximately 13,580 Bitcoin, valued at £886 million. These cyber thefts are believed to fund North Korea's nuclear and ballistic missile programs, with the Lazarus group playing a pivotal role in these operations.

Australian Investors Targeted in Cryptocurrency Scam

Over 130 Australians have fallen victim to a sophisticated cryptocurrency scam. Fraudsters impersonated representatives from the Binance exchange, claiming account compromises and directing victims to transfer funds to a "trust wallet" controlled by the scammers. Authorities emphasize the importance of verifying communications and reporting suspicious activities promptly.

Deep Dive: ISO 20022 & XRP – The Future of Financial Messaging

In the rapidly changing world of finance, where speed, transparency, and interoperability are more critical than ever, one technical standard is quietly reshaping the global financial system: ISO 20022.

This new messaging standard is more than just an upgrade—it's a complete language overhaul for how financial institutions around the world communicate. And at the heart of this transition? XRP, the digital asset from Ripple, which is already ISO 20022-compliant and uniquely positioned to thrive in this evolving financial ecosystem.

What is ISO 20022?

ISO 20022 is an international standard for electronic data interchange between financial institutions. It defines a common language and model for payments messaging that enhances the quality and richness of the data being transmitted.

Analogy: Think of ISO 20022 as upgrading from sending handwritten letters in different languages (old systems like SWIFT MT) to everyone using the same language, in rich email format, with attachments, emojis, and real-time tracking. It's faster, smarter, and far more efficient.

The global transition to ISO 20022 will allow banks, payment providers, and digital asset networks to communicate more clearly and efficiently across borders. It’s being adopted by major financial entities like the Federal Reserve, European Central Bank, and SWIFT.

Why XRP Matters in This Transition

Ripple’s XRP Ledger was built from the ground up for cross-border payments. It’s fast (3–5 seconds per transaction), scalable, and extremely cost-effective—traits that make it a natural fit for ISO 20022 implementation.

Ripple was the first blockchain company to join the ISO 20022 standards body back in 2020. That means its technology is already aligned with this global shift. RippleNet, Ripple’s global payment network, is ISO 20022-native, giving banks and payment institutions a plug-and-play bridge to this new era of finance.

Analogy: While many other cryptocurrencies are trying to build a bridge to the future financial system, XRP is already waiting on the other side of that bridge, waving everyone over.

How ISO 20022 Could Change Everything

Here’s how ISO 20022 will shake up the global financial system—and how XRP stands to benefit:

Richer Data Transmission: Instead of limited transaction details, financial messages will carry more structured and complete information—perfect for audits, compliance, and fraud prevention.

Interoperability: ISO 20022 enables smoother interaction between banks, fintechs, and blockchain networks. XRP, already fluent in this language, becomes a go-to solution for settlement.

Instant Cross-Border Payments: Traditional wire transfers can take 3–5 business days. ISO 20022, paired with XRP, enables near-instant transfers globally, with settlement finality in seconds.

Cost Efficiency: No more unnecessary intermediaries or hidden fees. XRP reduces the reliance on nostro/vostro accounts (the “bank of banks” system), cutting costs dramatically.

Stablecoins and RLUSD’s Role

In the ISO 20022 environment, stablecoins will also play a massive role—especially in liquidity management and tokenized fiat settlements. While XRP shines as a bridge asset between currencies, RLUSD (a regulatory-compliant, asset-backed stablecoin) offers stability during volatile market conditions.

RLUSD can serve as a parking spot for liquidity during transaction batching, or as a settlement layer when speed, transparency, and compliance are all priorities. When used together, RLUSD and XRP provide a powerful duo:

RLUSD preserves value.

XRP enables movement.

Analogy: If XRP is the high-speed bullet train connecting cities, RLUSD is the safe, climate-controlled station where passengers wait between transfers.

Institutional Adoption: A Matter of Time

It’s important to understand that financial institutions move slowly—but they are moving. ISO 20022’s deadline for major infrastructure adoption has already passed for most global systems. Ripple’s XRP and RLUSD-like stablecoins are at the center of new payment models being tested by:

Central banks (via CBDC pilots),

Commercial banks (cross-border liquidity),

Enterprises (real-time treasury operations).

This isn’t hypothetical anymore. It’s happening behind the scenes, and retail investors are just beginning to see the ripple effects.

The Bottom Line

The implementation of ISO 20022 is one of the biggest paradigm shifts in modern financial history. It’s a foundational upgrade to the global payment rail system—comparable to going from landline to mobile phones.

And while many cryptocurrencies are still trying to prove their use case, XRP is already functioning in the environments ISO 20022 is building. Add RLUSD and other compliant stablecoins into the mix, and you have a recipe for a full-stack digital financial ecosystem.

Analogy: If crypto is a new kind of vehicle, ISO 20022 is the standardized highway system it’s going to drive on. XRP is the sleek electric car already in motion—and RLUSD is the energy station that keeps it running efficiently.

What are your thoughts on ISO20022? Let us know in the comments! 👇

Note: The information provided is based on the current market conditions as of March 21, 2025, and is subject to change with market dynamics.

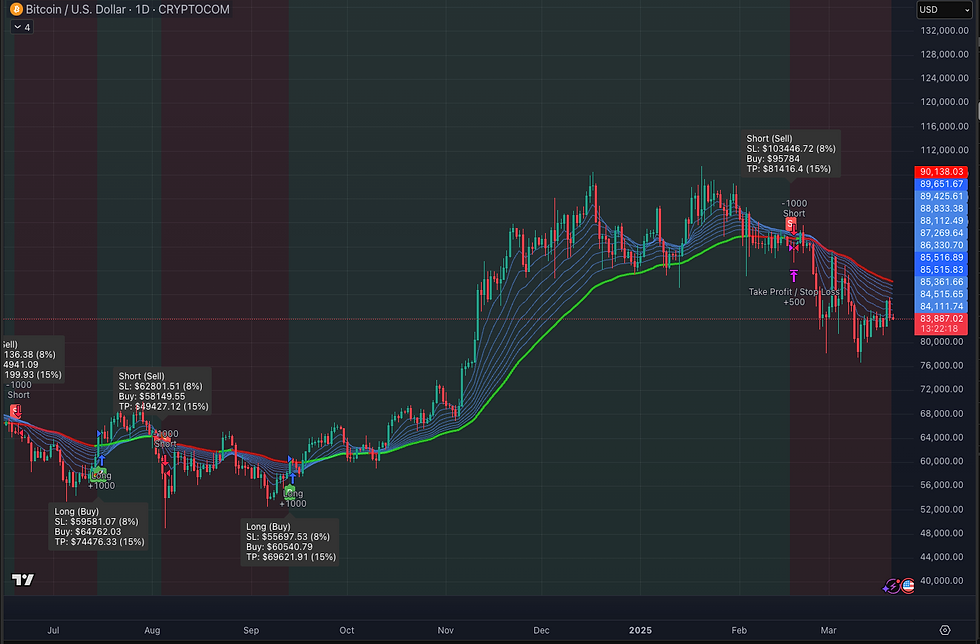

Do you want to know when to buy and when to sell a crypto? Opt-In for Free Crypto Trade Alerts (Beta)

Introducing the Crypto Alpha Ultimate Algorithm BETA—Now in Beta & Free for Early Subscribers!

Get real-time crypto trade alerts directly to your email & phone.

Why Join?

Powered by the Crypto Alpha Algorithm: Identifies optimal buy/sell signals based on real-time market conditions.

Institutional-Grade Data: Leveraging cutting-edge analytics for maximum accuracy.

Beta Launch = Free Access!: Get in early while we fine-tune the algorithm.

This is your chance to get real-time insights from a powerful crypto market algorithm at no cost.

👇 Opt-in now and start receiving trade alerts!

Comments